Here’s why you need to invest in a Payroll Software today!

If you’re doing Payroll calculations in Excel, here are 6 reasons why you should switch to Payroll Software.

Payroll is an essential function of any business, from storing employee information, calculating pay, leave and deductions and reporting relevant information and paying taxes to stay compliant. Wages are usually the biggest expense of a company, so maintaining reports with accuracy is of utmost importance. Even the smallest errors can cause exponential damage to the company.

Keeping track of records manually increases the risk of errors. What’s more, manual maintenance drains your HR team’s time, which could be used in dealing with more pressing issues. When there is manual work there is bound to be manual errors and the only way to solve this problem is to use Payroll Software. Payroll software manages, maintains the entire payroll process. Payroll Software automates a lot of these processes. Many payroll software providers offer online self-service portals for your employees to request leave, view their payslips and update their documentation.

Here is are six concrete ways Payroll Software will benefit your business:

- Cost Effectiveness Time is money, and payroll software will help you save both. It will decrease the time your HR has to spend manually calculating, writing and then rewriting (because errors are unavoidable) and instead they can put the same effort into something more meaningful.

- Saves Collective Time Payroll software can have multiple users who can access the platform together or simultaneously. Unlike worksheets it does not have to be updated and manually shared across workers. This saves a lot of time as it makes the process more efficient and independent. The lack of errors caused by human error and the time spent on correcting them is also saved.

- Accurate Calculations The lack of manual work reduces the likelihood of miscalculations and errors. When you eliminate the human part of human error you are left with financially sound reports. Comprehensive validation procedures and checks stop you from entering the wrong information.

- Timely Compliance A company has to maintain hundreds of compliances- internal and statutory. When done manually they are bound to be missed or late, the result of which can be penalties, cancellation of license, judicial proceedings, etc. A payroll software automates the process and has proper alerts in place to ensure the timely payments to avoid any such situations.

- Data Security When multiple employees handle a single, or worse, multiple worksheets the chances of a data breach increases. Employee and company data which consists of sensitive data like financial and bank information falling into the wrong hands can create chaos and damage beyond repair. Payroll software has permission based systems which only allows access to employees with predefined rights by the administrator. In case of cloud servers, data backup is also ensured and data loss is avoidable.

- Improved employee productivity and morale With payroll software companies can maintain transparency and employees feel more comfortable dealing with management. The HR and Accounts department also works more productively when they can optimise their time while maintaining timeliness and accuracy is their work.

Payroll software is a way forward to streamline your HR processes.

Why choose Ichiban Payroll Guru?

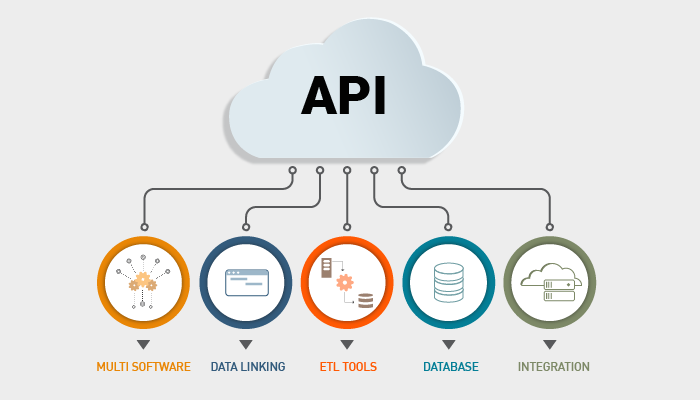

Ichiban Payroll Guru is an all in one Payroll Solution which automates your payroll processes, tax compliances and documentation so you can focus on what matters: the people. Developed by FACT Software, we offer a clean, simple user experience – whether you’re an HR Executive, People Manager or employee.

Ichiban Payroll Guru is also unique because it is an integrated payroll solution. It is seamlessly integrated with FACT ERP.NG so you can manage your entire business operations – finances, compliance, reporting and more – from just one screen.