Governance, Risk and Compliance: Not just for the Multinationals

Many countries are making wide-sweeping changes in how they tax products and services to generate more sales tax revenue, amongst other taxes for the entire economy, not just the large corporations. The vast majority of SMEs have been slow to change their compliance management processes, preferring to stick to what they already know. By doing so, they neglect the risks associated with tax compliance and fall prey to penalties from an ever growing list of rules and regulations – until it’s too late. SMEs lack the resources to stay on top of these changes, and financial and legal penalties can hit them much harder than large corporations with deep pockets. Here are just a few examples of Scenarios SMEs should prepare for:

- Identification and evaluation of tax risks based on your company’s tax objectives

- Appropriate organisational structure and governance processes that take into account enterprise- or industry-specific regulatory requirements

- Adequate record-keeping of tasks, responsibilities, authorisations and tax processes

- Timely identification and implementation of legal and/or regulatory changes

- Timely and correct tax reporting, payments and tax forecasting

- Calculation, evaluation, classification, and disclosure of tax liabilities and assets

The Top 4 Challenges of Managing Compliance Risk Manually

1. Manual Accounting Errors

Manual accounting of taxes can lead to multiple errors in filing. The work can lead to missed deadlines and attract huge penalties for the company.

2. Due Date Control

Different taxes have different due dates, and it can be difficult to keep track of them all. Manual monitoring increases the likelihood of error.

3. Real-time Task Mapping

Due dates are jeopardized when you do not have the ability to prioritize tasks in real-time.

4. Lack of Standardised Process

With different teams working on their own sheets for maintaining taxes, there is a lack of uniformity in the organisation. When it comes to final filing, everything is left in disarray.

With tax compliance software, days of burning midnight oil during tax-filing season is over. With different tax laws applicable in different countries, ERP solutions have evolved to ensure full tax compliance. This is an excellent opportunity for startups, growing organisations that are not using an ERP system, and companies that are using standalone ERP but are looking to get a new one or to upgrade the existing one with a tax compliant ERP system.

The Key Benefits of Risk Compliance Software

1. Automate Processes and Reduce Human Error

Centralised tax management software manages all compliance checks for Sales Tax, VAT, GST and other taxes. Eliminating manual workflows allows companies to seamlessly adapt to a wide variety of tax requirements.

2. Optimise Staff Time

Compliance software can help officers optimise the time they spend on taxes with intuitive user interfaces, easy identification of anomalies and reducing duplicate entries with smart auto-fill.

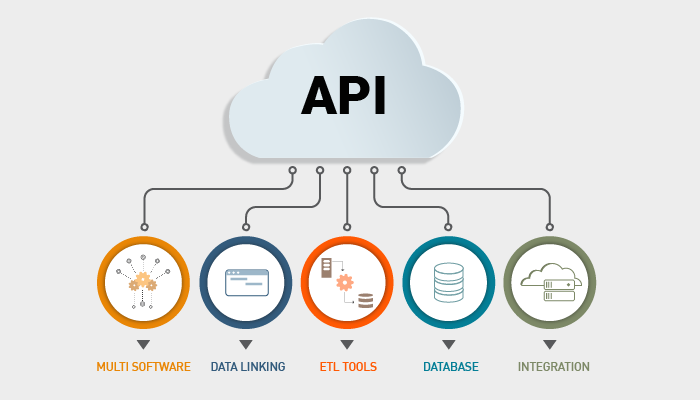

3. Ensure Seamless Integration

Integrate all other business solutions and manage them together with a compliance system. Distribute and manage remediation tasks while maintaining a full audit trail.

Compliance Monitor Guru, Your Trusted GRC Partner

Reduce your risk and never miss another due date or pay late charges with Compliance Monitor Guru. Compliance Monitor Guru is designed to give you complete control of your compliances and manage your risk. You can set up custom compliances for statutory and internal compliances for all aspects of your business. Track, assign and monitor compliances on a daily basis.