FACT ERP.NG is fully compliant with the new GST rules

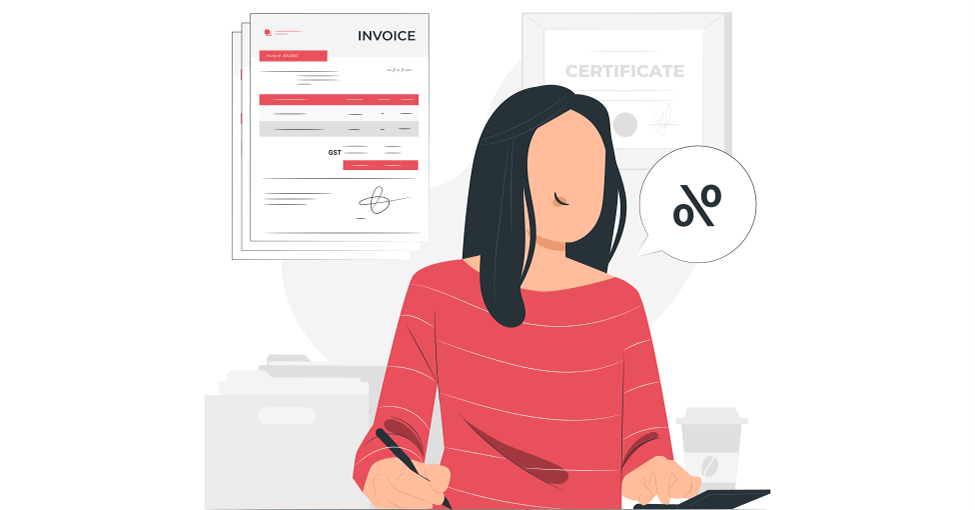

Have you heard about the new GST rule? GST E-invoicing is now Mandatory for any taxpayers with INR 5 Crores or above turnover in any financial year from 2017-18 with effect from 01 August 2023.

You might have a lot of questions in your mind on how to proceed with it, or if you even fall under this rule. Let’s answer all your doubts!

How do you know if this rule applies to you?

Did your company’s revenue exceed 5cr in any year since 2017? In other words, since 2017, if your company’s turnover has surpassed 5cr in any of the previous 6 years, then YES, you fall under this mandate and must begin E-Invoicing promptly before 01 August 2023.

What is E-Invoicing and how does it affect your Business?

It’s exactly what the name says. E-invoicing is defined by the GST Law as electronic invoicing. Businesses must produce an electronic invoice for all B2B transactions.

The E-invoicing mandate is a step towards a more digitalized and transparent business environment in India.

Coming to how it affects your business, it’s all pros!

-

- Improved efficiency : E-invoicing streamlines the invoicing process, reducing manual efforts and errors. With E-invoicing, businesses can generate invoices quickly and accurately, improving their efficiency and productivity.

-

- Faster payment processing : E-invoicing enables faster payment processing by reducing the time it takes to generate and transmit invoices. This, in turn, leads to faster payment processing, improving cash flow for businesses.

-

- Reduced compliance burden : Eliminating the need for manual data entry, it reduces the compliance burden on businesses. There should not be any scope left for human errors because the penalties for incorrect invoices are INR 25,000 Per Invoice! We all want to avoid that don’t we?

-

- Better data accuracy : Improved data accuracy by reducing errors that may occur during manual data entry. With E-invoicing, businesses can ensure that their invoices are accurate, reducing the risk of disputes and disputes over payment.

-

- Enhanced transparency : E-invoicing promotes transparency in business transactions, as all invoices are digitally recorded and tracked. This enhances trust between businesses and their customers, improving business relationships.

What are the Penalties of not E-Invoicing?

- Higher of 100% of Tax Due or INR 10,000 for non-issuance of E-Invoice

- INR 25,000 for incorrect invoicing

- Detention of Goods & Vehicles by Tax Officer without valid E-Invoice

- Buyers may not accept goods or make payment without Valid E-Invoice as they will not be able to claim Input Tax Credit (ITC)

Why is the Government lowering the threshold?

Lowering the threshold will help in plugging revenue leakage and provide a better reconciliation of credits at the buyer’s end. Physical invoices have problems with matching data and human errors. This will be mitigated, and more credit will be available all around.

Well, if you are on-board with FACT, there is nothing to worry about! With Integrated compliance management and E-Invoicing services FACT makes sure you always stay compliant! From generating the IRN to uploading it on Portal, everything will be taken care of automatically, eliminating any manual work! If you are not on-board with us, no problem! Get in touch with our ERP specialists here and we will contact your team at the earliest!